Explore Milk vs Plant-Based Drinks Market Insights to meet global demand in Canada, Germany, and the Philippines. Partner with Interfresh for tailored solutions! The global beverage industry is more dynamic than ever, with evolving consumer preferences driving significant shifts in demand. Among the most prominent trends is the growing debate between milk and plant-based drinks, both vying for a dominant share of the market. For B2B buyers, including distributors and wholesalers, understanding the nuances of these two categories is vital for staying competitive. This blog delves into key market insights for Canada, Germany, and the Philippines, equipping B2B players with actionable strategies to meet consumer demands effectively.

Table of Contents

Global Beverage Trends

The global beverage market continues to expand as consumers seek healthier, more sustainable choices. While traditional milk remains a staple in many households, plant-based drinks are becoming mainstream, fueled by concerns over health, the environment, and dietary restrictions.

- The global plant-based beverage market is projected to grow at a compound annual growth rate (CAGR) of 12.7%, reaching $47.8 billion by 2030. (Source: Grand View Research)

- Dairy milk, despite challenges, holds strong with an estimated global value of $720 billion, thanks to its unmatched nutritional profile and innovative fortified variants. (Source: Statista)

Key Market Overview

Canada

- Trends: A rise in lactose intolerance awareness and health-conscious lifestyles has boosted demand for Milk vs Plant-Based Drinks.

- Consumer Insights: Urban centers such as Toronto and Vancouver lead the way in hybrid beverage consumption, blending dairy and plant-based ingredients for balanced nutrition.

- Opportunity: Wholesalers can target health-food stores and cafes, offering hybrid drinks as a bridge between traditional and plant-based products.

Germany

- Trends: Germany dominates the European plant-based beverage market, with almond and soy milk being the most popular. Sustainability and organic certifications are key drivers.

- Consumer Insights: Younger demographics prioritize eco-conscious choices, often selecting plant-based products over traditional dairy.

- Stat: Nearly 46% of Germans regularly consume Milk vs Plant-Based Drinks, reflecting a strong shift toward alternatives. (Source: Euromonitor)

- Opportunity: Focus on partnerships with suppliers that can provide sustainably sourced or certified organic products.

Philippines

- Trends: Milk fortified with vitamins remains a top choice for families, while plant-based options gain popularity among younger, urban consumers.

- Consumer Insights: Rising health awareness is driving demand for products that combine nutrition with convenience.

- Opportunity: Importers can capitalize on the growing urban market by introducing fortified plant-based drinks, catering to busy professionals and health-focused families.

Milk vs Plant-Based Drinks: Key Comparisons

Nutritional Value

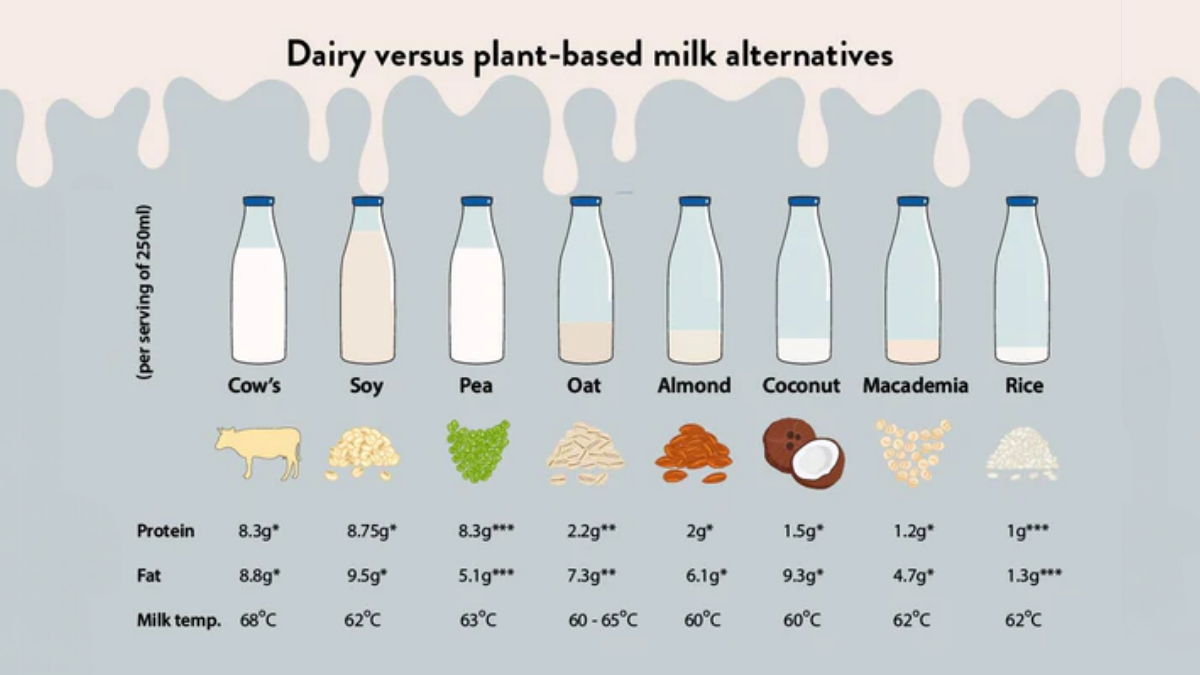

- Milk: A classic source of protein, calcium, and essential vitamins, milk’s reputation as a nutritional powerhouse remains strong.

- Plant-Based Drinks: While naturally lower in protein, many options are fortified with vitamins like B12, making them attractive to vegans and health-conscious consumers.

Taste and Versatility

- Milk: Known for its creamy texture and versatility, milk works well in a wide range of applications, from coffee to smoothies.

- Plant-Based Drinks: Almond milk offers a nutty flavor, oat milk a creamy texture, and soy milk an earthy undertone—each catering to specific tastes.

Environmental Impact

- Milk: The dairy industry faces scrutiny for its carbon footprint and water usage.

- Plant-Based Drinks: Often more eco-friendly, oat and almond milk are particularly favored for their lower environmental impact.

- Stat: Producing oat milk generates 80% less carbon dioxide than dairy milk. (Source: World Resources Institute)

Market Insights for B2B Buyers

Canada

- Focus: Hybrid beverages that combine the nutrition of milk with the plant-based appeal.

- Strategy: Partner with OEM manufacturers to develop lactose-free milk options fortified with plant-based proteins.

Germany

- Focus: Sustainably sourced plant-based beverages.

- Strategy: Work with organic-certified suppliers to cater to eco-conscious consumers. Highlight traceability and transparency in marketing efforts.

Philippines

- Focus: Fortified milk products for families and plant-based options for urban professionals.

- Strategy: Emphasize the health benefits of fortified drinks in advertising campaigns targeting working parents and young adults.

How Interfresh Can Support Your Business

Interfresh offers a wide array of solutions to help B2B buyers excel in the competitive beverage market:

Tailored Offerings

From nutrient-rich dairy Milk vs Plant-Based Drinks blends, Interfresh provides customizable products to meet diverse consumer needs.

Sustainability Commitment

All products are sourced with environmental impact in mind, ensuring alignment with global sustainability trends.

End-to-End Solutions

From formulation to packaging, Interfresh’s comprehensive OEM services streamline the process of bringing innovative beverages to market.

Tips for Successful Product Launches

Understand Regional Preferences

Example: In Germany, prioritize organic certifications; in the Philippines, focus on fortified products for families.

Embrace Innovation

Incorporate unique flavors or hybrid drinks to stand out in competitive markets.

Leverage Partnerships

Collaborate with trusted suppliers like Interfresh to ensure high-quality, innovative products.

Conclusion

The choice between Milk vs Plant-Based Drinks offers abundant opportunities for distributors and wholesalers. By understanding consumer preferences and leveraging market insights, B2B buyers can successfully navigate this growing segment. Interfresh provides the expertise and product innovation needed to thrive in this dynamic landscape.

FAQ

- Why do people switch to plant-based milk?

- What is the healthiest milk to drink daily?

- What country is most lactose intolerant?